Financial Advisor Survey 2019

Originally posted on Christian Investment Forum

The Faith Driven Investor movement stands on the shoulders of those who have come before us. John Siverling and the Christian Investment Forum are just one of the groups who have led this conversation, and we're grateful to feature their contribution to the movement here.

This 2019 Survey of Financial Advisors is the 3rd edition to study the current state of awareness, knowledge and use of Faith Driven Investing. The first study was completed in 2013 and followed by the 2nd edition in 2016.

The 2019 survey, similarly to the 2013 and 2016 versions, focused on three areas beyond general demographic information. The first objective was to understand advisor Awareness of Faith Driven Investing – what were the critical components, and how they perceived it as credible. The second objective was to assess advisor Knowledge levels about Faith Driven Investing – did they feel reasonably informed and comfortable with the practice so that they could effectively communicate it to clients. The third objective was to understand actual Usage of Faith Driven Investing by advisors and their clients, including possible barriers to increased use.

There are various terms used to describe investing that is purposefully aligned with Christian faith. Some of the more commonly used are Biblically responsible investing (BRI), Values based investing, Faith-based investing, and Morally responsible investing. In this report, the term Faith Driven Investing is used most often, but other terms may be used interchangeably.

From that survey data, following are the key takeaways:

Key Takeaway #1

Within the respondent pool, which is more closely aligned and sympathetic to faith and investing concepts, the AWARENESS of Faith Driven Investing and what makes up FDI remains at nearly universal familiarity, but there remains a sizable gap between that awareness and a more detailed functional awareness of the breadth of currently available product and service offerings.

Seventy-eight percent (78%) of respondents are members of Kingdom Advisors, and are more likely to be supporters of faith and investing concepts. Fifty-four percent (54%) of respondents were very familiar with Faith Driven Investing (FDI), and ninety-six percent (96%) felt they were at least somewhat familiar with the investing concepts. The advisors identified the main components of a Faith Driven Investing approach, but a large majority of them (87%) were not able to accurately recognize the number of Faith Driven Investing fund and product offerings available.

Key Takeaway #2

The level of KNOWLEDGE in Faith Driven Investing, and belief in the credibility of FDI, is growing but has yet to reach a tipping point where more client conversations are regularly occurring.

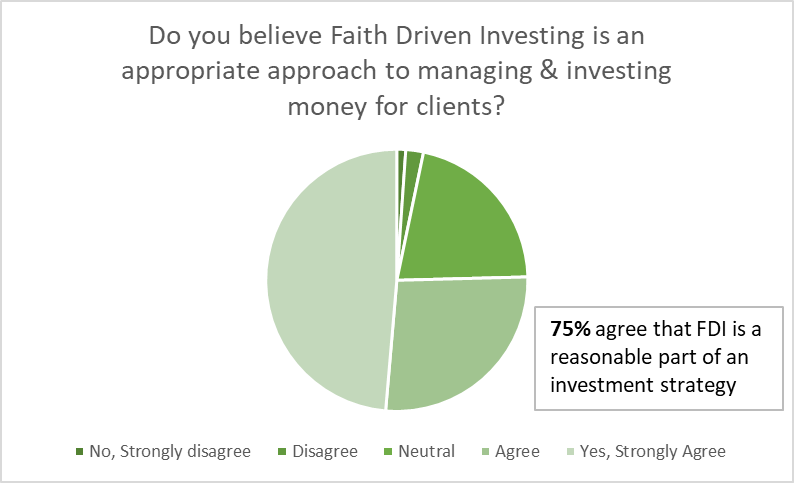

Just over half of the respondents (51%) felt well educated on Faith Driven Investing. Only three percent (3%) said they believe Faith Driven Investing is not a credible and appropriate way to manage client wealth, and ninety percent (90%) are interested in recommending investments that align with their clients’ faith and values.

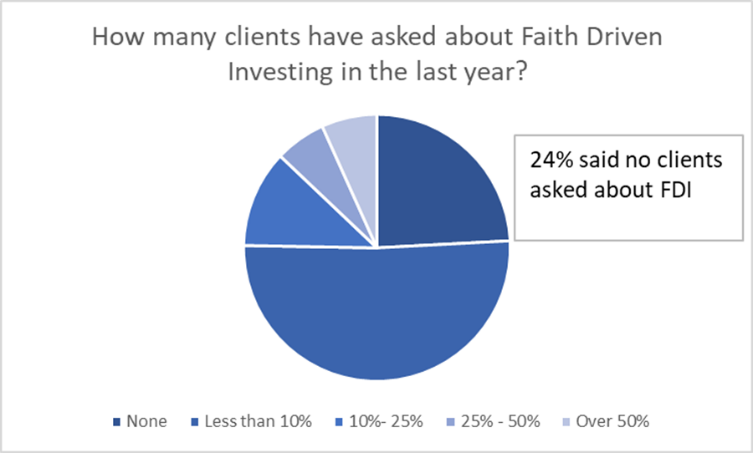

Yet when queried, seventy-five percent (75%) said that less than 10% of their clients had asked about Faith Driven Investing. Twenty-four percent (24%) had no client communication on Faith Driven Investing.

Key Takeaway #3

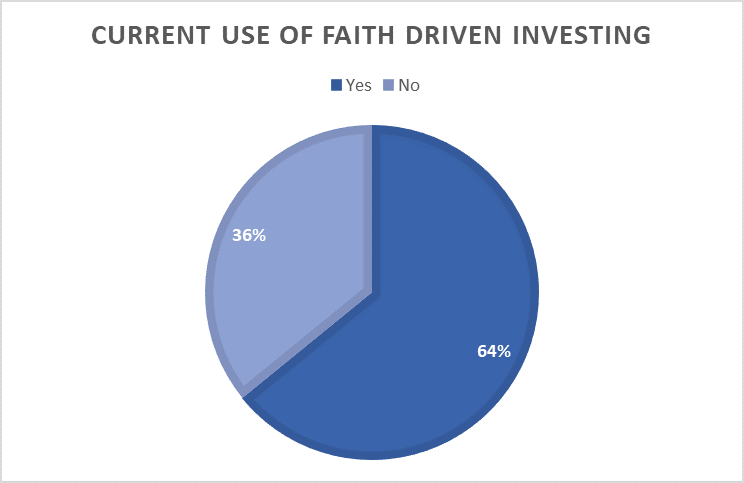

The Use of Faith Driven Investing is steadily increasing, with interest in recommending FDI to clients remaining well ahead of the usage patterns. This suggests that Faith Driven Investing could grow significantly with the continued development of resources and tools to overcome barriers.

Sixty-four percent (64%) of respondents indicated they currently use Faith Driven Investing with their clients, but for most of them the allocations to FDI remain small. Of those not using Faith Driven Investing currently, thirty-six percent (36%) were very interested to begin using FDI and another thirty-four percent (34%) were interested.

The top five reasons given for not using Faith Driven Investing were 1) No client demand, 2) Lack of information & knowledge, 3) Limited investment options, 4) Unproven performance, and 5) Need for better screening tools.

CONCLUSION

The results of this 2019 Survey of Financial Advisors on Faith Driven Investing Awareness and Use show continued, albeit slowing, improvements in all three areas – awareness, knowledge, and use. This slowing growth is relative to the last survey completed in 2016, which had shown more substantial improvements compared to 2013. In part this is due to a higher baseline, so sizable gains are more difficult to achieve.

To a large degree, the issues limiting the use of Faith Driven Investing remain the same since the initial study in 2013, though with some lessening in importance over the last 6 years with increased awareness and knowledge. There continue to be gaps in perception compared to reality on product availability and performance. Yet some further structural changes are needed – additional investment products that can more closely align with the different faith values of investors, increased acceptance of funds onto proprietary platforms, and additional research to support the already existing data on ESG, FDI, performance, and expenses.

The greatest opportunities to build momentum towards increasing the use of Faith Driven Investing are in helping encourage further education, and more importantly encourage conversations between advisors and investors. Both advisors and investors show high levels of interest in Faith Driven Investing, but neither advisors or investors are initiating a conversation or asking questions about FDI. More education on the topic of Faith Driven Investing can help to increase confidence for advisors to have the conversation. Similarly, more investor oriented information can help Christians recognize their role in asking questions of their financial advisor.

For those interested in supporting and growing Faith Driven Investing, there are strong reasons to be optimistic about the future growth in the use of FDI overall, and as a share of total assets under management. Data from this survey confirms previous research that a majority of investors and advisors alike have an interest in better aligning investments with the client’s personal faith and priorities. Macro trends in the market are showing investor interest in a more meaningful and integrated approach to investing in alignment with values. There are more organizations engaging in the conversation about FDI, and collaboration between them on messaging is improving. All of this helps to encourage others to understand they are not alone in desiring a more integrated approach to investing with their faith.